Search Users Posts Relevant to Forex Algorithmic Trading Wiki, Forex Robot-Best Expert Advisor For Automated Trading 99% Win Rate Forex For Beginners.

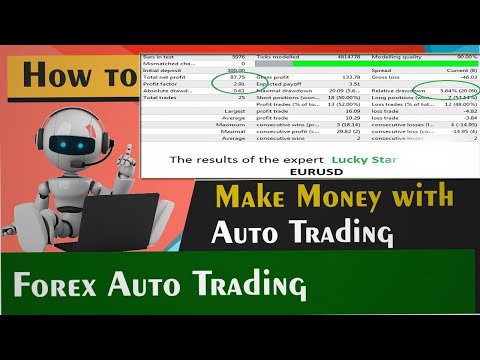

Forex Robot Trader – Best Expert Advisor For Automated Trading 99% Win Rate

Free Download

https://forexpasha.blogspot.com/2019/11/Lucky-Star-MACD-RSI-Most-Profitable-Best-Expert-Advisor-Forex-Trading-Robot.html

Best ABCD Pattern Trading – How to Trade The ABCD Harmonic Pattern Strategies

ABCD Pattern:

https://forexpasha.blogspot.com/2019/10/Best-ABCD-Pattern-Trading-How-to-Trade-The-ABCD-Harmonic-Pattern-Strategies.html

https://forexpasha.blogspot.com/2019/10/how-to-best-trade-Fibonacci-Retracement-trading-strategy-Support-ResistanceLevels.html

facebook

https://web.facebook.com/Forex-Pasha-107775087299617/

Lucky Star RSI, designed to participate in (and not just) the job of signal providers, advisors, as well as in various foreign exchange competitions, required on RSI indicators. Opens the number of orders. It can trade in a multi-currency variant See also Multi-currency Expert Advisory Signal Providers RSI and Fibonacci which have RSI indicators for Demark and Fibonacci.A series of experts: RSI and MACD, Lucky Star WPR, Lucky Star MA, Lucky Star SO, Lucky Star MACD, Lucky Star MA and SO, Lucky Star MA and MACD, Lucky Star SO and MCD Winning Real Money in Possibilities Management or Winning Bonuses in Real Accounts (read more on this in my blog). EAs can be set up under a number of rules for different competitions of different brokers, if indeed ots are allowed to trade robots. Property advisor Lucky Star has the ability to determine permission to trade robots and use the alert system. Alerts you while doing so. Alert a separate window will pop up with a sound alert, see; Alert at the Email 4 terminal will also alert you to any errors, if you mistakenly enter the account under the investment password. I logged in. The advisor will also determine the type of account (real, demo or competitive account, see screenshot) and inform you about it in the information panel.EA can trade around the clock unless you refuse it. Orders are arranged according to the indicator of the RSI (the signal can be converted to parallel and both, that is, in the first case, any first signal opens the orders; otherwise, the orders are open only. When both signals provide an initial signal), the closing orders are through action Stop loss, take profits, at the trailing stop or manually in the information panel (see screenshot), where you can turn off loss orders, profit. Profitable profits, or all active orders for all currency pairs on which the advisor is installed. Take advantage, eliminate losses, trailing stops and much higher prices, you choose yourself or set according to the rules of the competition (see blog). In the EA interface (see screenshot), you can carefully adjust the RSI indicator using different averaging methods. , Closing or opening bars (number of bars for the average), etc., using the MT4 Strategy Tester and your broker’s trading history.

Recommendation

Use MetaTrader 4 Forex trading platform

Major currency pairs EUR/USD

Favorite time to trade:Tokyo session,London session,New York session.

Best Time Frame:5-minute charts or 15-minute chart or 1-hour charts

Use Best Forex Brokers: Plus500,FXTM,XTB,Alpari,OctaFX,FPMarkets,Exness

Lucky Star MACD RSI Most Profitable Best Expert Advisor Free Download

Free Download Forex Indicators Of Buy and Sell Best Forex Trend Trading Indicators MT4|MT5

Free Download Forex Robot Trader – Best Expert Advisor For Automated Trading

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

……………………………………………..

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

forex trading wiki

orex trading in india

best forex trading platform

forex trading for beginners

forex trading tutorial

forex trading reviews

Forex Algorithmic Trading Wiki, Forex Robot-Best Expert Advisor For Automated Trading 99% Win Rate Forex For Beginners.

Is Zerodha touch totally free?

The Zerodha Touch Platform is currently totally free to use for Zerodha Trading Account holders, during the screening phase. 5) The length of time is Zerodha Touch Platform Free? The platform is totally free up until 31st March 2018. You can use upto 25 backtests and 5 live algos a day.

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

Skills Every Algo Trader Needs

To be a successful algo investor, you should have a few necessary skills. First, you ought to have the ability to trade, or a minimum of know the essentials of trading.

Do you know what a stop order is?

Or restriction order?

Do you know the margin demands for the market you wish to trade?

Is the exchange where you are trading regulated? Inquiries similar to this are very important. For example, it is vital you understand the threat inherent in uncontrolled exchanges.

Do you know specifics of the tool you wish to trade? For example, if you trade live cattle futures, do you know just how to prevent having 40,000 extra pounds of live cattle provided to your front backyard? I question it has actually ever happened to an investor, yet it is absolutely feasible. The more you understand about trading in general, the simpler the algo trading process will certainly be.

A second skill is being good at mathematics. You ought to have a good understanding of monetary estimations, fundamental data and calculating trading performance metrics. A relevant skill is being great with Excel or other data control software program such as Matlab. You will certainly be utilizing such software program a whole lot to supplement your trading strategy evaluation, so the better off you go to mathematics, the better you will certainly be at algo trading.

The third crucial skill is to know just how to run your selected trading platform. This seems like a basic skill, yet I constantly tell traders that they ought to keep learning their platform up until they can deceive it i.e., they can create trading systems that exploit weaknesses in the platform’s backtest engine. By being knowledgeable adequate to deceive the software program, you can prevent many rookie and intermediate level errors.

Being able to adhere to a well established scientific technique to trading system development is a 3rd skill every great algo investor has. To create solid trading systems, you need to have a sound process for making, developing and examining your algo strategies. It is not as simple as just shows and trading. If you do not have the skills or capability to adhere to an established process, algo trading could not be for you.

The final skill you require to have algo trading success is perhaps the most crucial – shows capability. Keep in mind a while when I talked about trading software program? Well, a crucial part of understanding which piece of software program to use is understanding your shows abilities. Various systems need various shows abilities, with some systems requiring C++ type shows skills, while others could just need drag and drop aesthetic shows skills. The trick is to be efficient in whatever shows language is called for.

Effective algo traders program hundreds or perhaps thousands of trading systems throughout a year. That is because a lot of trading systems are worthless they shed cash over time. Can you visualize paying a person to program worthless strategies for you? I sure can’t! So, shows capability is well worth your time if you wish to be a successful algo investor.

What Not To Do in Algorithmic Trading

Prior to I talk about a strong, tried and tested process to developing successful algo trading systems, it deserves explaining a few of the things NOT to do. Virtually every new algo investor falls into these risks, yet with a little forewarning, you can easily avoid them. Speaking from individual experience, guiding around these catches will certainly save you a great deal of cash.

First, because many algo traders have shows, science and mathematics histories, they think that their models require to be made complex. Besides, monetary markets are complicated monsters, and more trading rules and variables ought to be better able to design that behavior. INCORRECT! A lot more rules and variables are not better in any way. Yes, difficult models will certainly fit historical data better, yet monetary markets are noisy. Sometimes, having a great deal of rules just models the sound better, not the real underlying market signal. The majority of professional algo traders have simple models, because those often tend to work the very best moving forward on undetected data.

As soon as a trading system design is full, the 2nd mistake comes to be a problem: maximizing. Even if you have variables (such as moving typical sizes, or overbought/oversold thresholds) that could be enhanced does not indicate they ought to be enhanced. And also even if your computer can run a million backtest models a hr does not indicate you should. Maximizing is fantastic for developing outstanding backtests, yet keep in mind a lot of the market data is just sound. A trading strategy enhanced for a loud historic cost signal does not convert well to future performance.

A 3rd mistake is related to the first 2 risks: developing a terrific backtest. When you are developing an algo system, the only comments you jump on just how great it might be is using the historic backtest. So normally most traders try to make the backtest as best as feasible. A skilled algo investor, nevertheless, keeps in mind that the backtest does not matter nearly as long as actual time performance. Yes, a backtest needs to pay, yet when you find yourself trying to improve the backtest performance, you are in threat of falling into this trap.

A fourth and final algo trading mistake is the “as well great to be real” trap. Watch out for any type of historic result that just looks as well great to be real. Possibilities are it won’t perform nearly as well moving forward, it if carries out in any way. Virtually every algo investor I know has actually developed a minimum of one “Holy Grail” trading system, one with historic performance that would astound any type of financier or investor. However nearly without exception, those fantastic strategies crumble in real time. Possibly it was because of a programming error, over-optimization or tricking the strategy backtest engine, yet having a healthy dosage a suspicion at the outset keeps you far from strategies similar to this.

Search Popular Articles Relevant to Forex Algorithmic Trading Wiki and Financial market information, evaluation, trading signals and Foreign exchange broker reviews.

Risk Notice:

All items listed on our website TradingForexGuide.com are traded on leverage which suggests they carry a high level of risk and you might shed greater than your deposits. These items are not ideal for all investors. Please guarantee you fully recognize the threats and carefully consider your monetary scenario and trading experience before trading. Look for independent guidance if necessary.