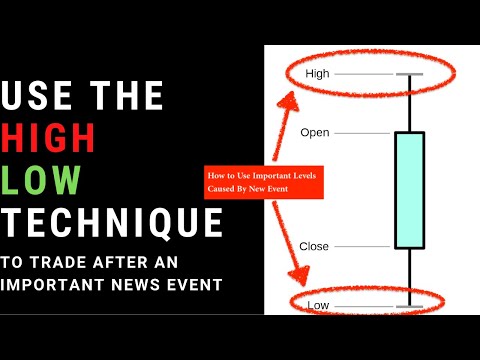

Explore Latest Vids Explaining Forex Position Trading Halt, Forex Market Analysis & Forecast: How to Trade After an Important Event with the High Low Technique.

In this forex trading tutorial video, I review what happened after FOMC last night. I also go into the importance of identifying the high/low of the candle during the release of the event/data.

👉FREE Day Trading Guide here: https://bit.ly/2zfCwlT

👉FREE Telegram Signal channel here: https://t.me/financialmarketwizards

👉Open an Account & Receive Bonuses here: https://bit.ly/2RuOTk2

Whether you are day trading or swing trading forex, you need to be paying attention to high impact news events like FOMC.

Do note that this is a technique and not a full-blown trading strategy on its own so please apply a proper trading strategy when trading.

If you are day trading live as the data is being released, please make sure to manage your risk and take your forex signals with the right position size as volatility is expected.

Trying to learn forex? Here at Financial Market Wizards, we do plenty of live forex trading videos such as this. In our live trading telegram channel, you can see how we do forex trading live.

Watching us day trading live is the best way to learn regardless of whether you are into swing trading or day trading. Live day trading signals are sent in our telegram channel so you can follow our forex live signals.

Make sure to hit the subscribe and turn on the notification bell for more videos like this: http://bit.ly/fmwsubscribe

Forex Position Trading Halt, Forex Market Analysis & Forecast: How to Trade After an Important Event with the High Low Technique.

What Is Long-Position?

A long position also known as simply long is the buying of a supply, commodity, or money with the expectation that it will rise in value. Holding a long position is a favorable view.

Long position and long are commonly utilized In the context of getting an options contract. The investor can hold either a long telephone call or a long put alternative, relying on the outlook for the underlying possession of the alternative contract.

A capitalist who wishes to take advantage of an upward price movement in a possession will “go long” on a phone call alternative. The call offers the owner the alternative to buy the underlying possession at a specific price.

Alternatively, an investor who expects a possession’s price to fall are bearish will be long on a put alternative and maintain the right to offer the possession at a specific price.

A long position is the reverse of a short position (brief).

A long lengthy position refers to the acquisition of a possession with the expectation it will raise in worth a favorable perspective.

A long position in alternatives contracts shows the owner owns the underlying possession.

A long position is the reverse of a short position.

In alternatives, being long can refer either to straight-out ownership of a possession or being the owner of a choice on the possession.

Being long on a supply or bond investment is a measurement of time.

Long Holding Investment.

Going long on a supply or bond is the more conventional investing method in the funding markets. With a long-position investment, the investor purchases a possession and owns it with the expectation that the price is going to rise. This investor generally has no plan to offer the safety and security in the future. In reference to holding equities, long refers to a measurement of time.

Going long on a supply or bond is the more conventional investing method in the funding markets, especially for retail financiers. An expectation that possessions will appreciate in worth in the future the buy and hold strategy spares the investor the requirement for constant market-watching or market-timing, and permits time to weather the unpreventable ups and downs. Plus, background is on one’s side, as the securities market undoubtedly values, with time.

Obviously, that doesn’t suggest there can’t be sharp, portfolio-decimating declines in the process, which can be deadly if one occurs right before, state, an investor was planning to retire or needed to liquidate holdings for some reason. A prolonged bear market can also be problematic, as it commonly favors short-sellers and those banking on declines.

Lastly, going long in the outright-ownership sense indicates an excellent amount of funding is locked up, which can cause missing out on various other chances.

Long Placement Choices Contracts.

Worldwide of alternatives contracts, the term long has nothing to do with the measurement of time however rather talks to the owning of a hidden possession. The lengthy position owner is one who presently holds the underlying possession in their portfolio.

When a trader gets or holds a phone call alternatives contract from an options author they are long, due to the power they keep in having the ability to buy the possession. A capitalist who is long a phone call alternative is one who gets a phone call with the expectation that the underlying safety and security will raise in worth. The lengthy position telephone call owner thinks the possession’s worth is increasing and may choose to exercise their alternative to buy it by the expiry day.

Yet not every investor who holds a long position thinks the possession’s worth will raise. The investor who owns the underlying possession in their portfolio and thinks the worth will fall can buy a put alternative contract.

They still have a long position because they have the capacity to offer the underlying possession they keep in their portfolio. The owner of a long position put thinks the price of a possession will fall. They hold the alternative with the hope that they will have the ability to offer the underlying possession at an useful price by the expiry.

So, as you see, the lengthy position on an options contract can express either a favorable or bearish view relying on whether the lengthy contract is a put or a phone call.

In contrast, the brief position on an options contract does not own the stock or various other underlying possession however obtains it with the expectation of selling it and afterwards repurchasing it at a lower price.

Long Futures Dealings.

Investors and businesses can also become part of a long forward or futures contract to hedge versus unfavorable price activities.

A business can use a long hedge to lock in a purchase price for a commodity that is needed in the future.

Futures vary from alternatives because the owner is obliged to buy or offer the underlying possession. They do not get to select however need to finish these activities.

Mean a precious jewelry manufacturer thinks the price of gold is poised to transform upwards in the short-term. The company can become part of a long futures contract with its gold vendor to purchase gold in 3 months from the vendor at $1.3K. In 3 months, whether the price is above or listed below $1,300, business that has a long position on gold futures is obliged to purchase the gold from the vendor at the concurred contract price of $1,300. The vendor, consequently, is obliged to deliver the physical commodity when the contract ends.

Speculators also go long on futures when they think the rates will go up. They don’t always want the physical commodity, as they are just interested in capitalizing on the price movement. Before expiry, a speculator holding a long futures contract can offer the contract in the marketplace.

Explore Latest Vids Explaining Forex Position Trading Halt and Financial market news, evaluation, trading signals and Forex investor evaluations.

Please Note:

The information offered by TradingForexGuide.com (TFG) is for general informational and instructional objectives just. It is not meant and need to not be taken to constitute guidance. If such information is acted upon by you then this need to be exclusively at your discretion and TradingForexGuide.com (TFG) will not be held accountable and accountable in any way.