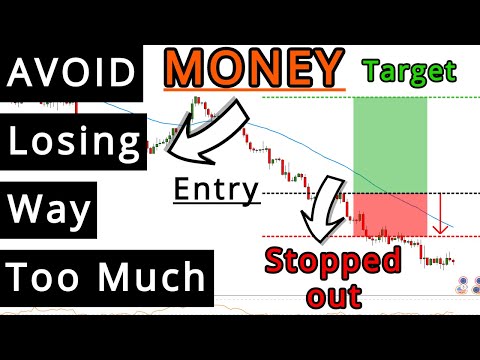

Read Users Videos Explaining Forex Position Trading Risk, Forex: How To Use Risk Management To Become A Pro Trader – (A Penny Saved Is A Penny Earned).

EAP Training Program – https://eaptrainingprogram.com/video-sales-page

Pro Trader Report – https://protraderreport.com/ptr

Free Spreadsheet – FREE course 3 – Part Reversal Series – https://goo.gl/QKaxzV

JOIN: “Advanced Pattern Mastery Course” Waiting List-https://advancedpatternmasterycourse.com/overview

———————————–

Full Strategy Videos –

Double Top/Bottom Entry Video – https://youtu.be/6rqfqC79DTY

5 – Wick Rejection Entry Video – https://youtu.be/J1JmNaqLzNM

CONNECT WITH STEVEN ON SOCIAL MEDIA:

Instagram: https://instagram.com/thetradingchannel/

https://instagram.com/stevenkiethhart/

Facebook: https://www.facebook.com/thetradingchannel.net/

————————————-

CLICK HERE TO SUBSCRIBE TO STEVEN’S YOUTUBE CHANNEL NOW:

https://www.youtube.com/channel/UCGL9…

————————————-

Enjoyed this video? Check out more videos about predictive analysis:

The #1 Trend Trading Technique Of All Time:

https://www.youtube.com/watch?v=rWOwM…

The ULTIMATE beginners guide to reading a candlestick chart:

https://www.youtube.com/watch?v=jmoOr…

over 217,000 views…

How To Identify Powerful Support/Resistance:

https://www.youtube.com/watch?v=vJ-sR…

Over 127,000 views

The ULTIMATE beginners guide to Price Action Trading:

https://www.youtube.com/watch?v=k8n4D…

Predictive Analysis 101 For Beginners:

https://www.youtube.com/watch?v=Gulqb…

Using structure to Defeat the markets:

https://www.youtube.com/watch?v=bHTwS…

How To Do Technical Analysis:

https://www.youtube.com/watch?v=cPDea…

Top 2 Best Currency Trading Indicators:

https://www.youtube.com/watch?v=cvGBj…

*****

In this video, Steven shares some advanced structure trading techniques for the Forex market and a few key steps to building a Forex trading strategy.

———————————–

BIO

Steven Hart –

Steven was recognized as a top 30 Trading educator on YouTube by the very critical feedspot.com.

Link – https://blog.feedspot.com/trading_you…

He became a self-made professional trader at 20 years old. Today he is the “Honest Trading Coach” to hundreds of thousands of traders around the world.

He is the founder and CEO of The Trading Channel.

For over 9 years Steven has studied the science of trading and psychology. This combination allows him to not only be an incredible trader, but a very understandable teacher as well.

He has developed numerous rules-based trading systems and strategies that are used by top traders around the world.

Today, Steven is on a mission to help 1,000 traders become independently profitable over the next 12 months. Will you be one of them?

JOIN US IN OUR LATEST FREE TRAINING:

Link – https://thetradingchannel.org/optin

———————————–

CONNECT WITH STEVEN ON SOCIAL MEDIA:

Instagram: https://instagram.com/thetradingchannel/

https://instagram.com/stevenkiethhart/

Facebook: https://goo.gl/pgwbov

OTHER LINKS:

Intro music provided by – https://www.youtube.com/user/ThisIsTh…

Song link – https://www.youtube.com/watch?v=2Ax_E…

Outro music provided by – TULE – Fearless pt.II (feat. Chris Linton) [NCS Release]

Song link – https://youtu.be/S19UcWdOA-I

#supportandresistance#fx#forex

Forex Position Trading Risk, Forex: How To Use Risk Management To Become A Pro Trader – (A Penny Saved Is A Penny Earned).

Comprehending Short Placements.

When developing a brief setting, one must recognize that the trader has a limited capacity to gain a profit as well as limitless capacity for losses. That is due to the fact that the capacity for an earnings is restricted to the stock’s range to no. Nonetheless, a stock could possibly rise for many years, making a collection of greater highs. One of one of the most unsafe aspects of being short is the capacity for a short-squeeze.

A short-squeeze is when a heavily shorted supply unexpectedly begins to boost in rate as investors that are short begin to cover the stock. One well-known short-squeeze occurred in October 2008 when the shares of Volkswagen surged greater as short-sellers rushed to cover their shares. Throughout the short-squeeze, the stock increased from roughly EUR200 to EUR1000 in a little over a month.

What is a Short-Position.

A brief, or a brief placement, is created when an investor sells a safety and security initially with the intention of redeeming it or covering it later at a reduced rate. An investor might make a decision to short a safety when she believes that the cost of that safety is most likely to reduce in the near future. There are 2 types of brief placements: naked and covered. A nude short is when a trader markets a safety without having ownership of it. Nonetheless, that method is prohibited in the U.S. for equities. A covered short is when a trader borrows the shares from a stock car loan division; in return, the investor pays a borrow-rate while the short setting is in area.

In the futures or forex markets, short positions can be created any time.

Understanding Brief Positions.

When producing a short position, one should understand that the investor has a limited possibility to gain a profit as well as infinite possibility for losses. That is due to the fact that the capacity for an earnings is restricted to the stock’s range to zero. Nonetheless, a supply could possibly increase for many years, making a collection of greater highs. Among the most unsafe facets of being short is the possibility for a short-squeeze.

A short-squeeze is when a greatly shorted supply unexpectedly starts to increase in price as investors that are short begin to cover the supply. One well-known short-squeeze occurred in October 2008 when the shares of Volkswagen surged higher as short-sellers clambered to cover their shares. Throughout the short-squeeze, the supply rose from approximately EUR200 to EUR1000 in a little over a month.

- A brief placement describes a trading technique in which a financier sells a protection with plans to buy it later.

- Shorting is a method made use of when a financier anticipates the cost of a protection will fall in the short-term.

- Alike practice, brief vendors obtain shares of stock from a financial investment financial institution or various other banks, paying a charge to borrow the shares while the short position remains in location.

Search Popular Articles Explaining Forex Position Trading Risk and Financial market news, evaluation, trading signals and Forex broker testimonials.

Risk Disclaimer:

All products listed on our website TradingForexGuide.com are traded on leverage which means they lug a high level of risk and also you might shed more than your deposits. These products are not appropriate for all investors. Please ensure you fully understand the dangers and carefully consider your financial situation as well as trading experience prior to trading. Look for independent suggestions if required.