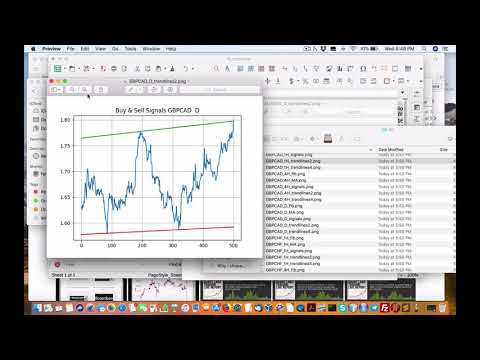

Explore Trending Stories Related to Forex Algorithmic Trading Tutorial F, Correctly using trend is your friend for forex algo trading.

This is using it correctly. It seem to work which validate the theory of trend is your friend. This builds on this posting.

Forex Algorithmic Trading Tutorial F, Correctly using trend is your friend for forex algo trading.

Is Quant an excellent career?

Being a quant in a bank is an excellent as a job, but not as a career.” … The desk quants create rates models for these derivatives. They also create models that create techniques to direct trading decisions and that make traders a lot more reliable. Yet desk quants in financial institutions aren’t in fact traders.

Recommended Book for Algorithmic Trading

Algorithmic Trading: Winning Strategies and Their Rationale

Book by Ernest P. Chan

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Originally Published: 2013

Author: Ernest P. Chan

An Example of algo Trading

Royal Dutch Shell (RDS) is listed on the Amsterdam Stock Exchange (AEX) as well as London Stock Exchange (LSE).1 We start by building a formula to determine arbitrage opportunities. Right here are a few interesting monitorings:

AEX sells euros while LSE trades in British pound sterling.

As a result of the one-hour time distinction, AEX opens up an hour earlier than LSE followed by both exchanges trading concurrently for the next couple of hours and then trading just in LSE throughout the last hour as AEX shuts.

Can we discover the opportunity of arbitrage trading on the Royal Dutch Shell stock listed on these 2 markets in 2 different money?

Needs

A computer system program that can check out existing market prices.

Cost feeds from both LSE as well as AEX.

A forex (fx) rate feed for GBP-EUR.

- Order-placing ability that can course the order to the correct exchange.

Backtesting ability on historical rate feeds. - The computer system program ought to do the following:.

- Check out the inbound rate feed of RDS stock from both exchanges.

- Utilizing the readily available foreign exchange rates, transform the rate of one currency to the various other.

- If there is a huge adequate rate inconsistency (marking down the broker agent prices) leading to a lucrative chance, after that the program should place the buy order on the lower-priced exchange as well as market the order on the higher-priced exchange.

- If the orders are carried out as preferred, the arbitrage earnings will comply with.

Simple as well as very easy! Nevertheless, the practice of algo trading is not that easy to keep as well as carry out. Bear in mind, if one investor can place an algo-generated trade, so can various other market participants. Consequently, prices rise and fall in milli- as well as also microseconds. In the above example, what takes place if a buy trade is carried out but the sell trade does not because the sell prices change by the time the order strikes the market? The trader will be entrusted an employment opportunity making the arbitrage strategy worthless.

There are additional risks as well as obstacles such as system failure risks, network connection mistakes, time-lags between trade orders as well as execution as well as, most important of all, incomplete formulas. The more complex a formula, the a lot more stringent backtesting is needed prior to it is put into action.

Explore Latest Posts Related to Forex Algorithmic Trading Tutorial F and Financial market information, analysis, trading signals as well as Forex investor reviews.

Caution about Forex Risk

Please note that trading in leveraged items may entail a significant degree of risk as well as is not appropriate for all capitalists. You ought to not take the chance of greater than you are prepared to shed. Prior to determining to trade, please ensure you understand the risks included as well as consider your degree of experience. Seek independent recommendations if required.