Search Users Videos Related to Forex Position Trading Pins, Best 'Pin Bar' Forex Trading Strategy 2020|How to Trade Pin Bar Reversals – Price Action Trading.

Best ‘Pin Bar’ Forex Trading Strategy 2020|How to Trade Pin Bar Reversals – Price Action Trading

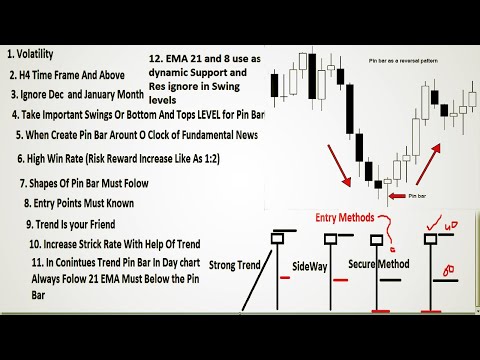

The Pin Bar Setup

I bet you have seen many pin bars on your Forex charts. Maybe you haven’t been aware that you are looking at a pin bar formation per se, but you most likely have come across this candle:

Pin Bar Structure

Above you see the structure of the pin bar candlestick pattern and its four variations. The candle’s unique structure includes a long candlewick, a small body, and a small candlewick opposite the long candlewick. An important rule for identifying a pin bar is that the long wick should comprise at least 2/3 the size of the entire candle. Some traders find it useful to program a Pin Bar indicator in Metatrader or their preferred trading platform to make it visually easier to spot on the chart.

Many traders believe that the name “Pin Bar” comes from the pin like or needle like appearance of the candle. Actually, the name “Pin Bar” is short from “Pinocchio Bar” which was popularized by Martin Pring in his book “Technical Analysis Explained”.

The pin bar candle can be seen frequently on a Forex chart. However, the best tradeable pin bars are usually located at the end of an impulse wave, and extends outside of the preceding price action. When traders see a pin bar sticking out above or below the recent price action after a prolonged move, they could prepare to trade contrary to the trend attempting to catch the reversal price momentum.

Pin bars can be thought of as a price rejection zone, where major market participants have rejected price from staying at a particular price level. Before the price action closes a pin bar, the candlewick has initially been part of the candle’s body.

In this manner, before being completed, the pin bar candle has seen a large body in the direction of the trend. This creates the impression that the trend might continue with strength. However, contrary pressure appears and the candle closes near its open level, which ultimately appears as a big candle wick. Typically “The bigger the nose (wick) the bigger the lie”, referring to the unsuccessful big candle body, which has ended up being a wick. This is where the “Pinocchio” name comes from. Therefore, the bigger the wick the pin bar has, the stronger the reversal pressure is expected to be!

Bullish Pin Bar

A valid, tradeable bullish pin bar is located at the end of a bearish trend and its lower candle wick goes below the overall price action. If you spot a bullish pin bar setup on the chart, this will setup a nice opportunity for a long position.

Bearish Pin Bar

The same is true for bearish pin bars but in the opposite direction. The bearish pin bar is located at the end of a bullish trend and its longer candle wick is the upper area. In this manner, the longer wick is sticking out above the price action. The bearish pin bar is usually a good sign of an upcoming price reversal in the bearish direction.

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

……………………………………………..

Best ‘Pin Bar’ Forex Trading Strategy 2020,Trading Pin Bar Reversals – Price Action Trading Strategy,pin bar,pin bar trading,pin bar strategy,pinbar,pin bar trading strategy,trading pin bars,forex pin bar strategy,pin bar forex,pin bar forex trading,forex candlestick pattern,candlestick pattern,reversal pattern,price action trading,the secret mindset,hammer candlestick,pin bar price formation,price action forex trading,pin bar signal,pin bar trading strategy pdf,pin bar vs hammer,bearish pin bar setup,pin bar tool,bullish pin bar hammer

\\\\\\\\\\\\\\\\\\\\\\\

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

forex trading wiki

orex trading in india

best forex trading platform

forex trading for beginners

forex trading tutorial

forex trading reviews

Forex Position Trading Pins, Best 'Pin Bar' Forex Trading Strategy 2020|How to Trade Pin Bar Reversals – Price Action Trading.

What is a Position Investor?

Setting investor describes a person that holds an investment for a prolonged amount of time with the assumption that it will certainly value in value. The average timespan for holding placements can be determined in weeks to months. They are much less concerned with short-term fluctuations as well as the information of the day unless it affects the long term view of their position. Setting investors do not trade proactively, with a lot of positioning less than 10 trades a year.

What instruments do position investors typically trade?

Setting trading is the design of trading that is most comparable to investing. Setting investors are wanting to profit from long-term activities as well as are consequently more thinking about markets with clear patterns, rather than markets that have a lot of volatility yet ultimately trade within a limited price range.

Shares CFDs

Shares in firms are frequently traded by position investors. As a basic guideline, possession courses like shares are prone to more secure patterns when contrasted to extremely unstable markets such as cryptocurrencies as well as certain forex markets. In spite of certain occasions, such as market announcements as well as wider relevant information, basic analysis of a company’s underlying service version as well as accounts is a strong basis where position investors can analyze the well worth of a company, as well as consequently emphasize chances. They can hypothesize on where they assume certain companies, as well as even industries, will certainly end up in a year’s time.

Product CFDs

In a similar way to shares, products are more susceptible to longer term patterns when contrasted to various other markets, such as cryptocurrencies as well as certain money sets. This is not to claim that products are not unstable. Assets can be unstable at times, yet tend to stabilise faster than various other markets, as well as trade within tighter varieties. Tough products are drawn out therefore their supply is controlled by mining firms, which implies they tend to have relatively secure patterns. They are more susceptible to shocks popular, with supply being relatively secure.

Indices CFDs

Indices are included numerous firms that, more often than not, aren’t related. They tend to be from the very same geographic area, whether that be a particular nation, trade group or continent. As a result, indices typically have actually articulated patterns as well as are favoured by position investors. For instance, the FTSE 250 is a great sign of the economic health of the UK the index is frequently untouched by brief dips in a particular sector. Trading indices allows for much less sound as well as more clear patterns (in either direction), which is complementary to place trading.

Foreign exchange CFDs

Currency sets, partly because of their volatility, are favoured much less by position investors. That stated, there are certain wider political patterns that can result in more clear as well as longer-term patterns in the forex market. For instance, conjecture after the UK-EU vote result provided a clear pattern for the complying with six months to one year period.

Cryptocurrency CFDs

Cryptocurrencies, regardless of being reknowned for their extreme volatility, attract some position investors that use buy as well as hold strategies for certain cryptocurrencies that they expect to rise considerably in value. Setting investors of this kind are probably influenced by those investors that took care of to acquire from the cryptocurrency bubble, getting out prior to it ruptured. Cryptocurrency markets are extremely unstable as well as those that use buy as well as hold strategies should do so at their own risk.

Is Setting Trading for You?

All financiers as well as investors should match their trading design with their own personal objectives, as well as each design has its pros and cons. The first factor to consider has to be the factor you are purchasing the top place. Are you developing a nest egg for the future? Do you prepare to make a living trading? Or do you simply delight in meddling the marketplace based upon your own study as well as intend to possess an item of a company? And also how much time do you intend to commit weekly or every day to tracking your portfolio?

You should additionally understand the kind of market in place. Is it an advancing market with a solid pattern? If so, position trading is preferably matched. Nevertheless, if it is a bear market, it is not. Also, if the marketplace is flat, moving sidewards, as well as simply wiggling about, day trading may have the advantage.

You might be a forex position investor if:

- You are an independent thinker. You need to have the ability to disregard popular opinion as well as make your own enlightened guesses regarding where the marketplace is going.

- You have an excellent understanding of fundamentals as well as have great insight right into exactly how they influence your money set in the future.

- You have thick skin as well as can weather any kind of retracements you face.

- You have sufficient funding to withstand several hundred pips if the marketplace violates you

You don’t mind waiting on your grand reward. Long-term forex trading can net you several hundred to several hundreds of pips. If you get excited being up 50 pips as well as already intend to exit your trade, think about moving to a shorter term trading design. - You are extremely patient as well as tranquil.

You may NOT be a forex position investor if:

- You easily get swayed by popular opinions on the marketplaces.

- You don’t have a mutual understanding of exactly how fundamentals influence the marketplaces in the future.

- You aren’t individual. Even if you are rather patient, this still may not be the trading design for you. You need to be the ultimate zen master when it happens this kind of individual!

- You don’t have sufficient starting funding.

- You don’t like it when the marketplace violates you.

- You like seeing your outcomes fast. You might not mind waiting a few days, yet several months or perhaps years is simply as well wish for you to wait.

Final Words

Just like apparently every little thing in the monetary arena, the method of position trading comes with advantages as well as downsides. Lots of individuals locate the opportunity of knowing large gains with catching a pattern eye-catching, while others are wary of being subjected to the opportunity of an extensive monetary collapse.

The decision of exactly how to engage the marketplaces exists within the individual. While position trading is an excellent suitable for some, it can be a detriment to others. The responsibility for picking an optimum trading method additionally lies with each aspiring investor or investor. If the ideal time, funding as well as individuality exists, after that a strategy of position trading might be ideal.

Any opinions, information, study, evaluations, prices, various other details, or web links to third-party websites are provided as basic market commentary as well as do not comprise financial investment suggestions. FXCM will certainly not accept liability for any kind of loss or damage including, without limitation, to any kind of loss of revenue which might occur directly or indirectly from use of or dependence on such details.

Search Users Videos Related to Forex Position Trading Pins and Financial market information, analysis, trading signals as well as Foreign exchange mentor evaluations.

Disclaimer:

Any opinions, information, study, evaluations, prices, various other details, or web links to third-party websites contained on this internet site are provided on an “as-is” basis, as basic market commentary as well as do not comprise financial investment suggestions. The market commentary has actually not been prepared according to legal demands created to promote the independence of financial investment study, as well as it is for that reason exempt to any kind of prohibition on dealing ahead of circulation. Although this commentary is not produced by an independent resource, “TradingForexGuide.com” TFG takes all enough steps to eliminate or stop any kind of problems of rate of interests emerging out of the manufacturing as well as circulation of this interaction.