Find More Vids Top Searched Forex Algorithmic Trading In Matlab, Automated Trading System Development with MATLAB.

Free MATLAB Trial: https://goo.gl/yXuXnS

Request a Quote: https://goo.gl/wNKDSg

Contact Us: https://goo.gl/RjJAkE

Learn more about MATLAB: https://goo.gl/8QV7ZZ

Learn more about Simulink: https://goo.gl/nqnbLe

Want to learn how to create an automated trading system that can handle multiple trading accounts, multiple asset classes, and trade across multiple trading venues? Simultaneously?

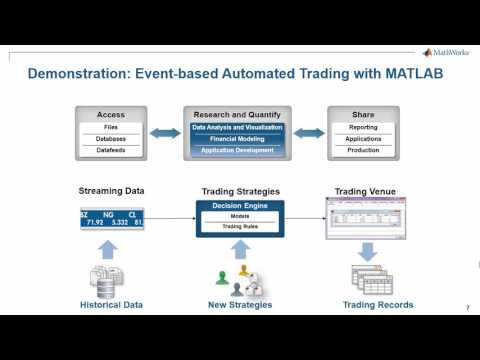

In this webinar we will present an example workflow for researching, implementing, testing and deploying an automated trading strategy providing maximum flexibility in what and who you trade with. You will learn how MATLAB® products can be used for data gathering, data analysis and visualization, model development and calibration, backtesting, walk forward testing, integration with existing systems and ultimately deployment for real-time trading. We look at each of the parts in this process and see how MATLAB provides a single platform that allows the efficient solution of all parts of this problem.

Specific topics include:

Data gathering options, including daily historic, intraday, and real-time data

Model building and prototyping in MATLAB

Backtesting and calibrating a model

Walk forward testing and model validation

Interacting with existing libraries and software for trade execution

Deployment of the final application in a number of environments, including .NET, JAVA, and Excel

Tools for high frequency trading, including parallel computing, GPUs, and C code generation from MATLAB

Forex Algorithmic Trading In Matlab, Automated Trading System Development with MATLAB.

That utilizes artificial intelligence trading?

artificial intelligence trading is mainly made use of by institutional financiers and also large brokerage firm residences to minimize expenses related to trading. According to research, artificial intelligence trading is specifically valuable for large order dimensions that might comprise as long as 10% of general trading quantity.

Recommended Book for Algorithmic Trading

Algorithmic Trading: Winning Strategies and Their Rationale

Book by Ernest P. Chan

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Originally Published: 2013

Author: Ernest P. Chan

Multiple Trading Algorithms Are Traded As Part of A Larger Algorithmic Trading System

Each artificial intelligence trading method supplied has numerous staminas and also weaknesses. Their staminas and also weaknesses are determined based on three potential market states: Solid Up, Sideways & Down relocating markets. The Momentum ES trading method can exceed in up relocating markets, while the treasury note algorithm masters descending and also laterally relocating markets. Checkout the following collection of video clips, where each trading algorithm supplied is examined by our lead designer. The staminas of each trading algo is examined in addition to it’s weaknesses.

Multiple Types of Trading

Methods Are Utilized in Our Automated Trading Software Application

Day trades are gotten in & left the same day, while swing trades will take a longer term profession based on expectations for the S&P 500 to trend higher or lower in the intermediate term.

Swing Trading Methods

The following Swing Trading Methods position directional swing trades on the S&P 500 Emini Futures (ES) and also the 10 Years Note (TY). They are made use of in both of the automated trading systems we offer to benefit from longer term fads our market prediction formulas are anticipating.

Futures Swing Trading Strategy # 1: Momentum Swing Trading Formula

The Momentum Swing Trading Strategy locations swing trades on the Emini S&P Futures, making the most of market problems that recommend an intermediate term move higher. This trading algorithm is made use of in three of our automated trading systems: The S&P Crusher, Pro Investor & The Swing Investor.

Futures Swing Trading Strategy # 2: 10 Years Treasury Keep In Mind Formula

The Treasury Note (TY) Trading Strategy locations swing trades on the Ten Year Note (TY). Because the TY typically relocates inverted to the broader markets, this method creates a swing profession that is similar to shorting the S&P 500. This T-Note algo has positive expectations for down relocating market problems. This trading algorithm is made use of in all of our automated trading systems: The S&P Crusher, Pro Investor, Wave Investor & The Swing Investor.

Futures Swing Trading Strategy # 3: Geronimo Swing Trading Formula

The Geronimo Swing Trading Strategy places swing trades on the Emini S&P Futures, making the most of market problems that recommend a short-term move higher. It differs from the Momentum ES algo, in that it typically gets out of the profession quicker and also places less trades (just the highest likelihood swing trades). This trading algorithm is made use of in 2 of our automated trading systems: The Pro Investor & The Wave Investor.

Day Trading Methods

The following day trading strategies position day trades on the S&P 500 Emini Futures (ES). They generally become part of trades during the initial 20 minutes after the equity markets opened up and also will get out prior to the markets close. Limited stops are utilized whatsoever times.

Futures Day Trading Strategy # 1: Day Trading Short Formula

The Short Day Trading Strategy places day trades on the Emini S&P Futures when the marketplace reveals weakness in the early morning (favors a huge gap down). This trading method is utilized in the S&P Crusher v2 automated trading system.

Futures Day Trading Strategy # 2: Outbreak Day Trading Formula

The Outbreak Day Trading Strategy places day trades on the Emini-S & P Futures when the marketplace reveals strength in the early morning. This futures trading method is utilized in the S&P Crusher v2 automated trading system.

Futures Day Trading Strategy # 3: Morning Void Day Trading Formula

The Morning Void Day Trading Strategy locations brief day trades on the Emini S&P Futures when the marketplace has a huge gap up, followed by a short period of weakness. This trading method is utilized in the S&P Crusher v2 automated trading system.

While each of these trading strategies can be traded stand alone, they are best traded in a broader collection of trading formulas as seen in one of our Automated Trading Solutions such as The Swing Investor.

Find Trending info Top Searched Forex Algorithmic Trading In Matlab and Financial market news, evaluation, trading signals and also Foreign exchange mentor testimonials.

Risk Caution:

Our solution consists of items that are traded on margin and also carry a danger of losses over of your deposited funds. The items might not appropriate for all financiers. Please make certain that you completely understand the dangers included.