Read New Posts Top Searched Forex Algorithmic Trading With Matlab, Algorithmic Trading with MATLAB for Financial Applications – Trading in MATLAB.

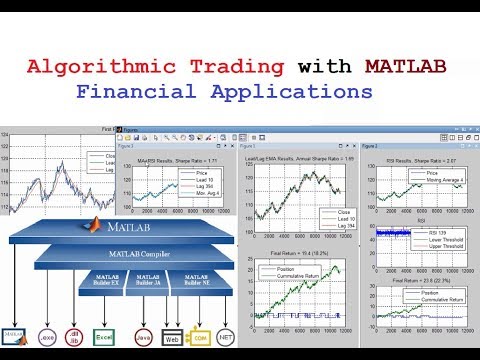

Algorithmic Trading with MATLAB for Financial Applications

(Tutoial From MATHWORKS site)

Stuart Kozola, MathWorks

Learn how MATLAB can support the prototyping and development of algorithmic trading in your organization.

Algorithmic trading is a complex and multi-dimensional problem; there are a large number of different challenges that need to be addressed and solved. At its heart one needs to be able to develop, build and test a robust trading algorithm, but this process requires one to solve a range of surrounding issues including data gathering, preparation and visualization, model development, backtesting, calibration, integration with existing systems and ultimately deployment. We look at each of the parts in this process and see how MATLAB provides a single platform that allows the efficient solution of all parts of this problem.

Specific topics include:

Data gathering options, including daily historic, intraday, and real-time data

Model building and prototyping in MATLAB

Backtesting and calibrating a model

Interacting with existing libraries and software

Deployment of the final application in a number of environments, including .NET, JAVA, and Excel

Tools for high frequency trading, including parallel computing, GPUs, and C code generation from MATLAB

View MATLAB example code from this webinar here.

About the Presenter: Stuart Kozola is a product manager at MathWorks and focuses on MATLAB® and add-on products for computational finance. Prior to joining MathWorks in 2006, Stuart worked at Pratt & Whitney (United Technologies) as a design engineer working on combustion systems for gas turbine engines. Stuart earned a B.S. in Chemical Engineering from the University of Wyoming, M.S. in Chemical Engineering from Arizona State University, M.S. in Electrical Engineering from Rensselaer Polytechnic Institute, and an M.B.A. from Carnegie Mellon University.

Product Focus

Parallel Computing Toolbox MATLAB

#Algorithmic_Trading_with_MATLAB

#Financial_Applications .

. #ToCourses

Patreon Account:

https://www.patreon.com/tocourses

Subscription Link:

https://bit.ly/2YrVCvU

Channel Link:

https://bit.ly/2ZjDaa4

Forex Algorithmic Trading With Matlab, Algorithmic Trading with MATLAB for Financial Applications – Trading in MATLAB.

What math do quants use?

A quant must recognize the complying with mathematical concepts: Calculus (consisting of differential, important and also stochastic) Straight algebra and also differential equations. Probability and also stats.

Recommended Book for Automated Trading

Professional Automated Trading: Theory and Practice

Book by Eugene A. Durenard

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

Originally published: 2013

Author: Eugene A. Durenard

Algo Trading Techniques

Any kind of method for artificial intelligence trading requires an identified possibility that is profitable in regards to enhanced revenues or expense reduction.

The complying with prevail trading methods made use of in algo-trading:

Trend-following Techniques

The most common artificial intelligence trading methods comply with fads in relocating averages, network outbreaks, price level movements, and also relevant technological indications. These are the easiest and also simplest methods to execute through artificial intelligence trading since these methods do not include making any kind of predictions or rate forecasts.

Trades are started based upon the occurrence of preferable fads, which are simple and also straightforward to execute through formulas without entering the intricacy of anticipating evaluation. Utilizing 50- and also 200-day relocating averages is a preferred trend-following method.

Arbitrage Opportunities

Acquiring a dual-listed supply at a reduced rate in one market and also simultaneously marketing it at a greater rate in another market provides the rate differential as safe profit or arbitrage. The exact same procedure can be reproduced for stocks vs. futures tools as rate differentials do exist from time to time. Applying a formula to determine such rate differentials and also putting the orders effectively permits profitable possibilities.

Index Fund Rebalancing

Index funds have actually specified durations of rebalancing to bring their holdings to par with their respective benchmark indices. This creates profitable possibilities for artificial intelligence traders, that capitalize on anticipated professions that offer 20 to 80 basis points revenues relying on the variety of stocks in the index fund prior to index fund rebalancing. Such professions are started by means of artificial intelligence trading systems for prompt execution and also the best rates.

Mathematical Model-based Techniques

Shown mathematical models, like the delta-neutral trading method, allow trading on a combination of options and also the underlying protection. (Delta neutral is a portfolio method containing numerous positions with countering positive and also negative deltas a proportion contrasting the adjustment in the rate of an asset, usually a valuable protection, to the corresponding adjustment in the rate of its derivative to ensure that the total delta of the possessions concerned totals zero.).

Trading Variety (Mean Reversion).

Mean reversion method is based upon the principle that the high and low rates of an asset are a momentary sensation that change to their mean value (typical value) regularly. Determining and also specifying a rate array and also implementing a formula based upon it permits professions to be placed immediately when the rate of an asset breaks in and also out of its specified array.

Volume-weighted Typical Rate (VWAP).

Volume-weighted typical rate method breaks up a large order and also releases dynamically figured out smaller sized chunks of the order to the marketplace using stock-specific historic volume profiles. The purpose is to carry out the order near to the volume-weighted typical rate (VWAP).

Time Weighted Average Rate (TWAP).

Time-weighted typical rate method breaks up a large order and also releases dynamically figured out smaller sized chunks of the order to the marketplace using evenly divided time slots in between a beginning and also end time. The purpose is to carry out the order near to the typical rate in between the begin and also end times thereby minimizing market influence.

Percentage of Volume (POV).

Up until the profession order is completely loaded, this formula proceeds sending out partial orders according to the specified participation proportion and also according to the volume sold the marketplaces. The relevant “steps method” sends orders at a user-defined portion of market volumes and also increases or lowers this participation price when the supply rate gets to user-defined levels.

Application Deficiency.

The execution shortfall method focuses on minimizing the execution expense of an order by trading off the real-time market, thereby saving on the expense of the order and also benefiting from the possibility expense of postponed execution. The method will certainly raise the targeted participation price when the supply rate actions favorably and also lower it when the supply rate actions adversely.

Beyond the Usual Trading Algorithms.

There are a couple of special classes of formulas that try to determine “happenings” beyond. These “sniffing formulas” made use of, as an example, by a sell-side market maker have the integrated knowledge to determine the presence of any kind of formulas on the buy side of a large order. Such discovery through formulas will certainly assist the marketplace maker determine large order possibilities and also enable them to benefit by filling up the orders at a greater rate. This is often recognized as modern front-running.

Technical Needs for artificial intelligence Trading.

Applying the formula using a computer program is the last element of artificial intelligence trading, accompanied by backtesting (trying the formula on historic durations of previous stock-market performance to see if using it would have been profitable). The obstacle is to change the recognized method right into an integrated electronic process that has access to a trading represent putting orders. The complying with are the requirements for artificial intelligence trading:

Computer-programming expertise to set the called for trading method, worked with developers, or pre-made trading software application.

Network connection and also access to trading platforms to place orders.

Access to market information feeds that will certainly be kept an eye on by the formula for possibilities to place orders.

The capacity and also framework to backtest the system once it is constructed prior to it goes survive on genuine markets.

Readily available historic information for backtesting relying on the intricacy of policies applied in the formula.

Read New info Top Searched Forex Algorithmic Trading With Matlab and Financial market news, evaluation, trading signals and also Forex broker testimonials.

Risk Warning:

“TradingForexGuide.com” TFG will certainly not be held liable for any kind of loss or damage arising from reliance on the info consisted of within this website consisting of market news, evaluation, trading signals and also Forex broker testimonials. The information consisted of in this website is not always real-time nor exact, and also analyses are the viewpoints of the writer and also do not stand for the referrals of “TradingForexGuide.com” TFG or its employees. Money trading on margin entails high risk, and also is not ideal for all capitalists. As a leveraged product losses are able to surpass initial deposits and also funding is at risk. Prior to deciding to trade Forex or any other economic tool you should very carefully consider your financial investment goals, level of experience, and also risk cravings. We work hard to offer you beneficial info about all of the brokers that we examine. In order to provide you with this cost-free solution we receive advertising fees from brokers, consisting of a few of those listed within our positions and also on this web page. While we do our utmost to ensure that all our information is up-to-date, we urge you to verify our info with the broker straight.