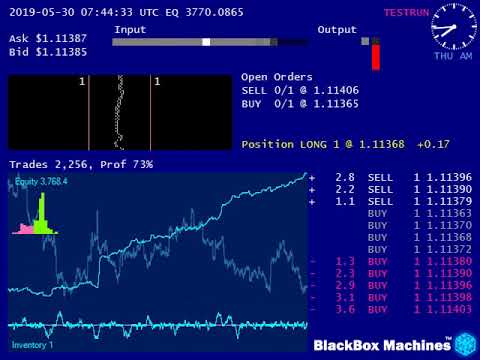

Find Interesting Articles About Forex Algorithmic Trading Market, Algorithmic Trading / Market Making Simulation Using Machine Learning.

Using sub-second tick bid/ask data, realistic fills and fee included.

Forex Algorithmic Trading Market, Algorithmic Trading / Market Making Simulation Using Machine Learning.

What is the most effective automated trading software program?

Quick Look: The Very Best Automated Trading Software Program.

Ideal Total: MetaTrader 4.

Best for Choices: eOption.

Best for Supply Trading: Interactive Brokers.

Best for Forex: MetaTrader 4.

Recommended Book for Algorithmic Trading

Algorithmic Trading: Winning Strategies and Their Rationale

Book by Ernest P. Chan

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…Originally Published: 2013

Author: Ernest P. ChanThe Ultimate Overview To Effective Algo Trading

Practically every person that has actually programmed a computer system to do

anything past outputting “Hi Globe” has actually dreamed of having a computer system algorithm (algo) working tirelessly to remove money from the monetary markets, be it in stocks, bitcoin, soybeans or anything else traded on an exchange. “Programming wizard, market killer” is a phrase we had actually all like to be related to. That is what a good algo investor is.

But exactly how practical is developing and also deploying a digital algo crawler, or a military of crawlers, to make money for you? And also, thinking it can be done, exactly how do you really tackle doing it? This guide walks you through the actions to becoming successful at algo trading. But be cautioned it is much more involved and also much more difficult than you might believe.The Fundamentals What Are We Really Talking About?

Before we get also far, there is some terminology associated with trading that will certainly help you recognize algo trading. There are 3 primary modes of trading. The first is optional trading, where an investor makes buy/sell choices based on any number of variables, some of which can be programmed, and also others such as instinct and also suspicions which can not. Lots of optional investors look at graphes or cost ladders on a computer system screen for hrs at a time, dealing as they go along.

The second kind of trading is algo trading. In years past, it was called mechanical, methodical, black box or rule based trading. Currently the majority of people refer to it as algo or algo trading, however the idea has actually not altered. The core ideology is that all the guidelines for trading (the “trading system” or “trading strategy”) are 100% defined, and also strictly adhered to. This makes algo trading perfect for a computer system to implement, and also also run automated in real time without human treatment. One substantial benefit of this style of trading is the guidelines can be historically examined, referred to as a “backtest.” By running a backtest, you can gain confidence in a trading algo prior to placing money behind it. If the guidelines were not rewarding in the past, they likely will not remain in the future!

The 3rd kind of trading combines optional and also algo trading. This is referred to as a crossbreed or grey box technique. For example, perhaps the entrances are based on an investor’s instinct, with only the leave guidelines electronic.

For the conversation listed below, we will certainly focus on the second technique pure algo trading – 100% electronic guidelines for buying and also marketing any instrument. We will certainly seek to algo trade on an exchange, which is just a physical or digital setting where customers and also vendors can implement trades.Why Should You Pay attention To Me?

Since we have basic terms down, you might be wondering why you must pay attention to me. First, I have actually been algo trading for over 25 years, and also most notably, not constantly effectively. Over the years, I have actually found out and also get over the risks in trading system style that torment several investors. This took years of hard work and also tuition (losses) paid to the marketplace. But at some point, I was able to make a go of algo trading, and also finished in 1st or second location 3 years straight in an around the world, actual money futures trading contest, earning over 100% in each of those years.

I was likewise able to attain the goal that tantalizes numerous part-time leisure activity investors – making the leap to full-time trading, which I still do today. In the process, I wrote 3 ideal marketing algo trading publications, and also I share my experiences worldwide through workshops, courses and also seminars.So, along with my early trading failures, I have actually had confirmed trading success. That is very important, since several trading educators have actually never ever also traded effectively! The procedure I outlined later on in this article is absolutely from somebody that has actually “existed, and also done that.”

Find Interesting Vids About Forex Algorithmic Trading Market and Financial market information, analysis, trading signals and also Forex broker evaluations.

Disclaimer about Risk

Please note that trading in leveraged products might involve a substantial level of risk and also is not suitable for all capitalists. You must not take the chance of greater than you are prepared to lose. Before deciding to trade, please ensure you recognize the threats included and also consider your level of experience. Look for independent guidance if necessary.