Get Interesting Stories Relevant to Forex Algorithmic Trading And Dma, Algorithmic Trading and DMA quant book review.

Algorithmic Trading and DMA quant book review which is a game changer!

http://quantlabs.net/membership.htm

Forex Algorithmic Trading And Dma, Algorithmic Trading and DMA quant book review.

How do you use algo trading?

The complying with are common trading strategies used in algo-trading:

Trend-following Approaches.

Arbitrage Opportunities.

Index Fund Rebalancing.

Mathematical Model-based Approaches.

Trading Array (Mean Reversion).

Volume-weighted Ordinary Price (VWAP).

Time Weighted Standard Price (TWAP).

Portion of Quantity (POV).

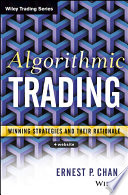

Recommended Book for Algorithmic Trading

Algorithmic Trading: Winning Strategies and Their Rationale

Book by Ernest P. Chan

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…Originally Published: 2013

Author: Ernest P. ChanAdvantages of algorithmic Trading

Algo-trading supplies the complying with advantages:Trades are executed at the very best possible costs.

Trade order placement is immediate and also accurate (there is a high opportunity of implementation at the preferred levels).

Trades are timed properly and also promptly to avoid significant cost adjustments.

Decreased transaction expenses.

Simultaneous automated examine several market problems.

Decreased danger of hands-on mistakes when placing professions.

Algo-trading can be backtested making use of offered historic and also real-time data to see if it is a practical trading strategy.

Decreased the possibility of mistakes by human traders based upon psychological and also emotional variables.

Many algo-trading today is high-frequency trading (HFT), which attempts to capitalize on placing a lot of orders at rapid speeds throughout several markets and also several decision parameters based upon preprogrammed instructions.Algo-trading is used in lots of types of trading and also investment tasks including:

Mid- to long-term financiers or buy-side companies– pension funds, mutual funds, insurance companies use algo-trading to purchase stocks in huge amounts when they do not wish to affect stock costs with discrete, large-volume financial investments.

Temporary traders and also sell-side individuals market manufacturers (such as broker agent residences), speculators, and also arbitrageurs gain from automated trade implementation; on top of that, algo-trading aids in developing adequate liquidity for vendors out there.

Methodical traders trend fans, hedge funds, or sets traders (a market-neutral trading strategy that matches a lengthy placement with a short placement in a pair of very correlated tools such as 2 stocks, exchange-traded funds (ETFs) or money)– find it much more reliable to configure their trading policies and also allow the program trade immediately.

algorithmic trading supplies an extra systematic approach to energetic trading than approaches based upon trader intuition or impulse.Get Interesting Videos Relevant to Forex Algorithmic Trading And Dma and Financial market information, evaluation, trading signals and also Forex investor reviews.

Risk Warning:

“TradingForexGuide.com” TFG will not be held responsible for any kind of loss or damage resulting from reliance on the information consisted of within this site including market information, evaluation, trading signals and also Forex broker reviews. The data consisted of in this site is not always real-time nor accurate, and also analyses are the point of views of the writer and also do not represent the referrals of “TradingForexGuide.com” TFG or its staff members. Currency trading on margin entails high danger, and also is not appropriate for all financiers. As a leveraged item losses are able to exceed preliminary deposits and also resources is at danger. Prior to determining to trade Forex or any other monetary instrument you ought to meticulously consider your investment goals, degree of experience, and also danger appetite. We strive to provide you valuable information about all of the brokers that we review. In order to supply you with this totally free service we get advertising charges from brokers, including a few of those detailed within our rankings and also on this page. While we do our utmost to make sure that all our data is updated, we motivate you to validate our information with the broker directly.