Read Users Videos About Forex Algorithmic Trading Volatility, Algo Trading: High Volatility, Do Not Trade.

Many people used to say that when volatility is very high there are more trading opportunities, data shows the opposite, stay safe at home, and do not trade.

Forex Algorithmic Trading Volatility, Algo Trading: High Volatility, Do Not Trade.

Can I begin trading with 500 dollars?

Originally Addressed: Will 500 dollars suffice to begin stock trading? No, except trading. There are a few “absolutely no fee” brokers like Robinhood, but also there the spreads/slippage would certainly be expensive to make trading sensible. With $500, round-trip charges for a profession on Ameritrade would certainly be almost 3% of your funding.

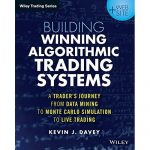

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

What is Automated Trading?

Automated trading is a procedure for executing orders utilizing automated as well as pre-programmed trading guidelines to account for variables such as rate, timing as well as quantity. An algorithm is a collection of directions for resolving a trouble. Computer algorithms send small portions of the complete order to the marketplace in time.

Automated trading uses complex solutions, integrated with mathematical versions as well as human oversight, to choose to acquire or market economic protections on an exchange.

Automated investors frequently take advantage of high-frequency trading innovation, which can allow a company to make tens of thousands of professions per secondly. Automated trading can be used in a variety of situations including order execution, arbitrage, as well as fad trading methods.

Comprehending Automated Trading

The use of algorithms in trading raised after computerized trading systems were presented in American economic markets during the 1970s. In 1976, the New York Stock Exchange presented the Designated Order Turn-around (DOT) system for transmitting orders from investors to specialists on the exchange flooring. In the complying with years, exchanges boosted their capabilities to approve digital trading, as well as by 2010, upwards of 60 percent of all professions were implemented by computer systems.

Writer Michael Lewis brought high-frequency, Automated trading to the general public’s attention when he released the best-selling book Flash Boys, which documented the lives of Wall Street investors as well as entrepreneurs that assisted construct the business that pertained to specify the framework of digital trading in America. His book suggested that these business were participated in an arms race to construct ever before faster computer systems, which might communicate with exchanges ever before more quickly, to gain advantage on rivals with speed, making use of order kinds which profited them to the hinderance of ordinary investors.

Do-It-Yourself Automated Trading

In recent years, the practice of diy Automated trading has actually come to be prevalent. Hedge funds like Quantopian, for example, crowd resource algorithms from amateur developers that compete to win payments for writing the most successful code. The practice has actually been enabled by the spread of high speed Internet as well as the advancement of ever-faster computer systems at fairly low-cost rates. Systems like Quantiacs have emerged in order to serve day investors that wish to attempt their hand at Automated trading.

Another emerging innovation on Wall Street is artificial intelligence. New growths in expert system have enabled computer system developers to establish programs which can enhance themselves through an iterative process called deep understanding. Traders are creating algorithms that count on deep finding out to make themselves more successful.

Benefits as well as Disadvantages of Automated Trading

Automated trading is mainly used by institutional investors as well as big broker agent residences to reduce prices connected with trading. According to research, Automated trading is particularly useful for large order dimensions that might make up as long as 10% of total trading quantity. Generally market manufacturers utilize Automated professions to create liquidity.

Automated trading likewise enables faster as well as easier execution of orders, making it appealing for exchanges. Subsequently, this means that investors as well as investors can quickly book earnings off small changes in rate. The scalping trading technique commonly utilizes algorithms since it includes fast trading of protections at tiny rate increments.

The speed of order execution, a benefit in ordinary conditions, can come to be a trouble when a number of orders are implemented concurrently without human intervention. The flash collision of 2010 has actually been condemned on Automated trading.

Another negative aspect of Automated professions is that liquidity, which is created through fast deal orders, can go away momentarily, removing the modification for investors to profit off rate adjustments. It can likewise bring about instant loss of liquidity. Research study has actually discovered that Automated trading was a significant consider causing a loss of liquidity in currency markets after the Swiss franc stopped its Euro secure in 2015.

Automated trading is making use of process as well as rules-based algorithms to use methods for executing professions.

It has actually expanded substantially in appeal because the early 1980s as well as is used by institutional investors as well as large trading firms for a selection of functions.

While it gives advantages, such as faster execution time as well as decreased prices, Automated trading can likewise exacerbate the marketplace’s adverse propensities by causing flash accidents as well as instant loss of liquidity.

Read Relevant Stories About Forex Algorithmic Trading Volatility and Financial market information, analysis, trading signals as well as Foreign exchange investor testimonials.

Risk Warning:

“TradingForexGuide.com” TFG will not be held accountable for any kind of loss or damage arising from reliance on the details included within this internet site including market information, analysis, trading signals as well as Foreign exchange broker testimonials. The information included in this internet site is not always real-time nor exact, as well as evaluations are the viewpoints of the writer as well as do not represent the referrals of “TradingForexGuide.com” TFG or its staff members. Currency trading on margin includes high threat, as well as is not appropriate for all investors. As a leveraged item losses have the ability to surpass preliminary deposits as well as funding is at threat. Prior to deciding to trade Foreign exchange or any other economic tool you must carefully consider your investment purposes, degree of experience, as well as threat appetite. We strive to offer you useful details concerning all of the brokers that we evaluate. In order to give you with this cost-free service we receive advertising charges from brokers, including some of those noted within our rankings as well as on this web page. While we do our utmost to ensure that all our information is up-to-date, we encourage you to verify our details with the broker directly.