Find More Videos Related to Forex Position Trading Group, Active Investments Group Long term Forex trading strategy. Small account growth.

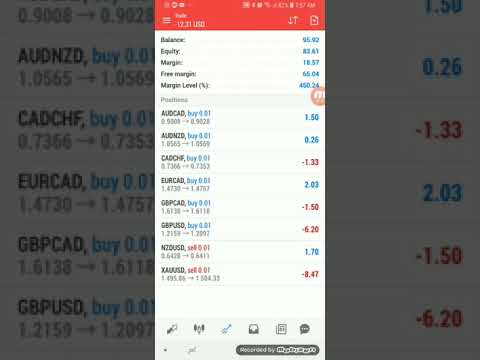

Let me show you how to grow a small account from stage to stage with my long term Forex trading strategy.

All you need is patience.

Forex Position Trading Group, Active Investments Group Long term Forex trading strategy. Small account growth.

What Is Long-Position?

A long placement likewise known as just long is the buying of a stock, asset, or currency with the assumption that it will rise in value. Holding a long placement is a favorable sight.

Lengthy placement and also long are usually used In the context of getting an options agreement. The trader can hold either a long call or a long placed choice, depending on the expectation for the hidden property of the choice agreement.

An investor who wants to gain from an upward price activity in a property will “go long” on a phone call choice. The call offers the owner the choice to buy the hidden property at a certain price.

On the other hand, a capitalist who anticipates a property’s price to fall are bearish will be long on a put choice and also maintain the right to market the property at a certain price.

A long placement is the opposite of a short placement (brief).

A long lengthy placement describes the purchase of a property with the assumption it will boost in value a favorable attitude.

A long placement in choices agreements suggests the owner possesses the hidden property.

A long placement is the opposite of a short placement.

In choices, being long can refer either to straight-out possession of a property or being the owner of a choice on the property.

Being long on a stock or bond financial investment is a dimension of time.

Long Holding Financial Investment.

Going long on a stock or bond is the more traditional investing technique in the resources markets. With a long-position financial investment, the investor purchases a property and also possesses it with the assumption that the price is going to climb. This investor usually has no strategy to market the protection in the near future. Of holding equities, long describes a dimension of time.

Going long on a stock or bond is the more traditional investing technique in the resources markets, specifically for retail financiers. An assumption that properties will value in value over time the buy and also hold technique spares the investor the need for continuous market-watching or market-timing, and also permits time to weather the inescapable ups and also downs. Plus, history gets on one’s side, as the stock exchange inevitably values, over time.

Naturally, that does not indicate there can not be sharp, portfolio-decimating drops along the way, which can be fatal if one occurs right before, state, a capitalist was preparing to retire or needed to sell off holdings somehow. A prolonged bear market can likewise be problematic, as it usually prefers short-sellers and also those betting on declines.

Finally, going long in the outright-ownership sense suggests a good amount of resources is locked up, which might lead to missing out on other opportunities.

Lengthy Setting Options Agreements.

On the planet of choices agreements, the term long has nothing to do with the measurement of time however instead talks with the owning of an underlying property. The lengthy placement owner is one who presently holds the hidden property in their portfolio.

When a trader purchases or holds a phone call choices agreement from an options author they are long, because of the power they keep in being able to buy the property. An investor who is long a phone call choice is one who purchases a phone call with the assumption that the hidden protection will boost in value. The lengthy placement call owner believes the property’s value is rising and also may make a decision to exercise their choice to buy it by the expiry date.

Yet not every trader who holds a long placement believes the property’s value will boost. The trader who possesses the hidden property in their portfolio and also believes the value will fall can buy a put choice agreement.

They still have a long placement since they have the ability to market the hidden property they keep in their portfolio. The owner of a long placement placed believes the price of a property will fall. They hold the choice with the hope that they will have the ability to market the hidden property at an advantageous price by the expiry.

So, as you see, the lengthy placement on an options agreement can express either a favorable or bearish sentiment depending on whether the lengthy agreement is a put or a phone call.

In contrast, the brief placement on an options agreement does not possess the supply or other hidden property however obtains it with the assumption of selling it and then buying it at a reduced price.

Long Futures Dealings.

Capitalists and also services can likewise participate in a long forward or futures agreement to hedge against damaging price activities.

A business can use a long bush to lock in a purchase price for a commodity that is needed in the future.

Futures differ from choices because the owner is obligated to buy or market the hidden property. They do not reach pick however should complete these activities.

Suppose a precious jewelry supplier believes the price of gold is positioned to transform upwards in the short-term. The firm can participate in a long futures agreement with its gold supplier to buy gold in three months from the supplier at thirteen hundred. In three months, whether the price is above or below $1,300, the business that has a long placement on gold futures is obligated to buy the gold from the supplier at the concurred agreement price of $1,300. The supplier, consequently, is obligated to provide the physical asset when the agreement ends.

Speculators likewise go long on futures when they believe the rates will go up. They don’t necessarily want the physical asset, as they are just thinking about capitalizing on the price activity. Before expiry, a speculator holding a long futures agreement can market the agreement in the market.

Find More Videos Related to Forex Position Trading Group and Financial market news, analysis, trading signals and also Foreign exchange investor testimonials.

Risk Disclaimer:

“TradingForexGuide.com” TFG will not be held accountable for any kind of loss or damages arising from reliance on the info contained within this website including market news, analysis, trading signals and also Foreign exchange broker testimonials. The information contained in this website is not necessarily real-time neither accurate, and also evaluations are the opinions of the writer and also do not stand for the recommendations of “TradingForexGuide.com” TFG or its staff members. Currency trading on margin entails high risk, and also is not ideal for all financiers. As a leveraged item losses are able to surpass initial down payments and also resources goes to risk. Before making a decision to trade Foreign exchange or any other economic instrument you ought to thoroughly consider your financial investment purposes, degree of experience, and also risk hunger. We work hard to supply you valuable info regarding every one of the brokers that we examine. In order to supply you with this totally free solution we obtain marketing fees from brokers, including several of those listed within our rankings and also on this web page. While we do our utmost to make certain that all our information is current, we urge you to confirm our info with the broker straight.