Find Users Articles Explaining Swing Trading Signals, Accumulative Swing Index Indicator | Generates amazing trading signals.

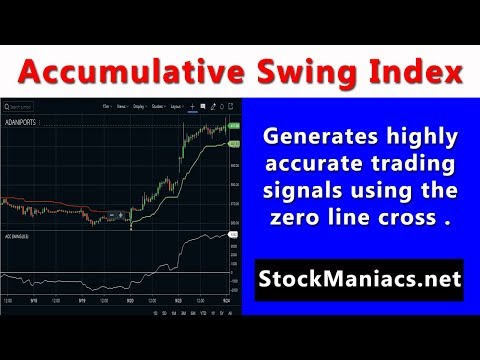

The accumulative swing index indicator is a cumulative total of the SI (swing index). Welles wilder introduced the indicator. It is basically a oscillator. The indicator is basically used as a divergence and confirmation tool. Besides this, it can be used for very good buy and sell signals too. Though it is specially designed for future trading, it can also be utilized for stocks and currency trading too.

Basically, it acts as a oscillator, swing between the scale of 0 to higher numbers (uptrend) and 0 to lower numbers (downtrend). It helps to identify the support resistance level and creates amazing signals using the zero line cross over. We can note swing high and low of the indicator and check that with a price chart to identify divergence.

The video contents accumulative swing index indicator strategy, formulas and lots more. So, to know how to make profit using the tool must watch the video carefully and put your comments in the box below.

For more such videos do not forget to subscribe to my channel. Traders trading under me can also be a part of my trading team by opening a trading and demat account under me. Whatsapp your name, mobile number and email to +91-9674321856.

—-

Know more about the Accumulative Swing Index indicator in my blog post here: https://www.stockmaniacs.net/accumulative-swing-index-indicator/

—-

Join Zerodha and get Zerodha Kite instantly: https://www.stockmaniacs.net/recommends/zerodha/open-account/

—-

Join Upstox and get Upstox Pro instantly: http://bit.ly/upstox

—-

Link to join my trading team: https://www.stockmaniacs.net/join-us-earn-5000-per-day/

—-

And Follow Us At:

—-

Website: http://www.stockmaniacs.net/

Twitter: https://twitter.com/stockmaniacs

Facebook: https://facebook.com/stockmaniacs

Google+: https://plus.google.com/+stockmaniacs

-~-~~-~~~-~~-~-

Please watch: “Camarilla Pivot Point Trading Strategy for Intraday Profit Live”

-~-~~-~~~-~~-~-

Swing Trading Signals, Accumulative Swing Index Indicator | Generates amazing trading signals.

Swing Trading Methods

A swing trader tends to look for multi-day chart patterns. Several of the extra usual patterns entail relocating average crossovers, cup-and-handle patterns, head and shoulders patterns, flags, and triangulars. Secret turnaround candlesticks might be made use of in addition to various other signs to develop a solid trading plan.

Ultimately, each swing trader designs a plan and strategy that provides a side over numerous professions. This includes searching for trade setups that often tend to lead to predictable motions in the property’s rate. This isn’t easy, and no strategy or configuration works every single time. With a desirable risk/reward, winning every single time isn’t needed. The extra favorable the risk/reward of a trading strategy, the less times it requires to win in order to create an overall profit over numerous professions.

Swing trading includes taking professions that last a number of days approximately several months in order to profit from an anticipated rate relocation.

Swing trading exposes an investor to over night and weekend danger, where the rate can space and open up the complying with the session at a considerably various rate.

Swing traders can take revenues making use of a well established risk/reward ratio based on a stop loss and profit target, or they can take revenues or losses based on a technical indication or rate action motions.

Discover Prospective Trades

Next, the trader will certainly check for possible professions for the day. Usually, swing traders will certainly get in a setting with an essential stimulant and take care of or leave the position with the help of technological evaluation. There are two great ways to discover essential catalysts:

Unique possibilities: These are best found by means of SEC filings and, in some cases, headline information. Such possibilities might consist of going publics (IPOs), insolvencies, expert buying, acquistions, requisitions, mergers, restructurings, purchases, and various other comparable events. Usually, these are found by keeping track of certain SEC filings, such as S-4 and 13D. This can be quickly finished with the assistance of websites such as SECFilings.com, which will certainly send out notices as quickly as such a filing is made. These kinds of possibilities usually bring a huge amount of danger, yet they deliver numerous rewards to those who thoroughly research each chance. These kinds of plays entail the swing trader buying when most are selling and selling when everybody else is purchasing, in an effort to “discolor” overreactions to information and events.

What do swing traders look for?

They are usually greatly traded supplies that are near a crucial support or resistance level. Swing traders will certainly look for several various kinds of patterns made to anticipate breakouts or break downs, such as triangulars, networks, Wolfe Waves, Fibonacci levels, Gann levels, and others.

Find Users Articles Explaining Swing Trading Signals.