Get Interesting Posts About Cfd Position Size Calculator, A Simple Formula For CFD Risk Management.

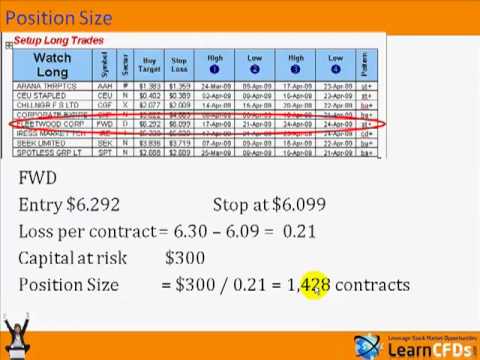

Risk Management is essential to your CFD trading success. Jeff Cartridge from http://www.learncfds.com will share with you his simple formula for controlling risk when trading CFDs.

Cfd Position Size Calculator, A Simple Formula For CFD Risk Management.

Comprehending Short Settings.

When producing a short placement, one must comprehend that the trader has a finite capacity to gain an earnings and also limitless possibility for losses. That is due to the fact that the possibility for a revenue is restricted to the supply’s distance to no. Nevertheless, a supply could potentially rise for several years, making a series of higher highs. Among the most hazardous aspects of being short is the possibility for a short-squeeze.

A short-squeeze is when a heavily shorted stock instantly starts to enhance in price as traders that are short begin to cover the stock. One famous short-squeeze happened in October 2008 when the shares of Volkswagen rose higher as short-sellers clambered to cover their shares. During the short-squeeze, the stock climbed from approximately EUR200 to EUR1000 in a little over a month.

What is a Short-Position.

A short, or a brief setting, is created when a trader offers a security initially with the intent of redeeming it or covering it later on at a reduced rate. An investor may determine to short a protection when she thinks that the rate of that safety and security is likely to reduce in the future. There are 2 kinds of brief placements: naked and covered. A naked brief is when an investor sells a security without having property of it. Nevertheless, that method is prohibited in the U.S. for equities. A protected brief is when a trader borrows the shares from a supply financing division; in return, the trader pays a borrow-rate while the brief position is in area.

In the futures or forex markets, brief positions can be produced at any time.

Comprehending Brief Settings.

When producing a short setting, one have to comprehend that the investor has a finite possibility to earn an earnings and also infinite capacity for losses. That is because the potential for a revenue is restricted to the stock’s distance to zero. Nonetheless, a stock can possibly climb for several years, making a collection of greater highs. One of the most harmful aspects of being short is the possibility for a short-squeeze.

A short-squeeze is when a greatly shorted supply instantly starts to raise in price as investors that are short begin to cover the supply. One famous short-squeeze happened in October 2008 when the shares of Volkswagen rose higher as short-sellers rushed to cover their shares. During the short-squeeze, the stock rose from about EUR200 to EUR1000 in a little over a month.

- A brief setting describes a trading strategy in which a capitalist offers a safety with plans to buy it later on.

- Shorting is a method made use of when a financier prepares for the cost of a safety and security will fall in the short-term.

- Alike technique, brief sellers borrow shares of supply from an investment financial institution or other banks, paying a charge to obtain the shares while the short placement is in place.

Search More Vids About Cfd Position Size Calculator and Financial market news, analysis, trading signals and Forex financial expert evaluations.

Risk Notice:

All products listed on our website TradingForexGuide.com are traded on take advantage of, which indicates they lug a high level of risk as well as you might lose greater than your down payments. These items are not appropriate for all financiers. Please ensure you totally recognize the risks and very carefully consider your financial scenario as well as trading experience prior to trading. Look for independent recommendations if needed.