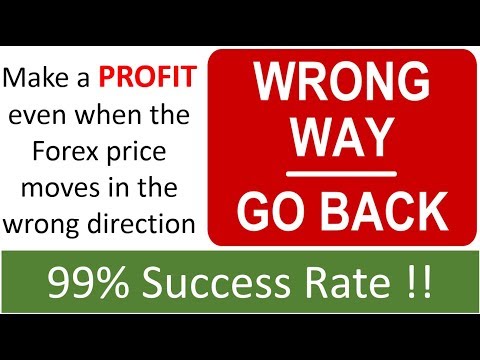

Find Latest Vids Relevant to Forex Position Trading Grid, 99% success, 242 winners, as Forex Grid EA trades in the WRONG way. Price never goes above buy entry.

http://www.gridtrendmultiplier.com/

During late April and early June a buy trend was anticipated for the AUD. The Grid Trend Multiplier was told to only enter buy trades.

Instead of bouncing on very strong support the price broke through very strong support and started is way down. The price took 6 weeks to retest the strong support which had now become resistance.

During that period over 1800 pips were generated resulting in a 45% return on the account used. A 99% success rate was achieved with 242 consecutive positive trades.

USEFUL LINKS:-

YouTube Subscribers 50% Discount https://www.expert4x.com/youtubespecial

*100 Free Forex trading tools:- https://forum.moneymakingforextools.com/?forum=662567

*4 Forex trading courses: https://forum.moneymakingforextools.com/?forum=641033

*+40 2020 Expert4x trading Webinar recordings https://www.youtube.com/playlist?list=PLda98agBeOd6KwdmugSk5pumZrbnJFSe6

*Have personal 1 on 1 trading meetings & attend our live trading workshops by joining our Forum at: https://www.forextradingsetups.com/

*60% off 3 EA Bundle: https://www.expert4x.com/cybermondayspecial

*82% OFF – 18 Forex Tool Bundle: https://www.expert4x.com/82PercentOff/

*Best performing EA – The Make Money EA: https://www.makemoneyexpertadvisor.com/

*Our EA Product list: https://www.expert4x.com/

YouTube Subscribers 50% Discount https://www.expert4x.com/youtubespecial

For a Regulated Forex Broker, use this link https://blueberrymarkets.com/lp/Expert4x

#expert4x#expert4xforextrading

#expert4xdouble

Forex Position Trading Grid, 99% success, 242 winners, as Forex Grid EA trades in the WRONG way. Price never goes above buy entry.

What Is Long-Position?

A long setting additionally called just long is the purchasing of a supply, product, or money with the assumption that it will rise in value. Holding a lengthy setting is a favorable sight.

Lengthy setting as well as long are often made use of In the context of buying a choices agreement. The investor can hold either a lengthy phone call or a long placed option, depending upon the outlook for the underlying asset of the option agreement.

A financier that wants to take advantage of an upward cost movement in an asset will “go long” on a call option. The call gives the holder the option to buy the underlying asset at a certain cost.

Alternatively, a capitalist that anticipates an asset’s cost to fall are bearish will be long on a put option as well as preserve the right to offer the asset at a certain cost.

A long setting is the opposite of a short setting (brief).

A long long setting refers to the purchase of an asset with the assumption it will increase in worth a favorable attitude.

A long setting in options contracts shows the holder has the underlying asset.

A long setting is the opposite of a short setting.

In options, being long can refer either to outright possession of an asset or being the holder of an option on the asset.

Being long on a supply or bond investment is a measurement of time.

Long Holding Financial Investment.

Going long on a supply or bond is the more conventional investing method in the funding markets. With a long-position investment, the capitalist purchases an asset as well as has it with the assumption that the cost is mosting likely to rise. This capitalist generally has no strategy to offer the security in the future. Of holding equities, long refers to a measurement of time.

Going long on a supply or bond is the more conventional investing method in the funding markets, particularly for retail financiers. An expectation that possessions will appreciate in worth over time the buy as well as hold strategy spares the capitalist the demand for consistent market-watching or market-timing, as well as permits time to weather the unavoidable ups as well as downs. And also, background is on one’s side, as the securities market undoubtedly values, in time.

Obviously, that does not suggest there can not be sharp, portfolio-decimating drops along the way, which can be deadly if one occurs right before, claim, a capitalist was preparing to retire or needed to sell off holdings for one reason or another. A long term bearish market can additionally be frustrating, as it often prefers short-sellers as well as those banking on decreases.

Ultimately, going long in the outright-ownership feeling means a great amount of funding is bound, which could cause losing out on various other possibilities.

Lengthy Position Choices Agreements.

In the world of options contracts, the term long has nothing to do with the dimension of time yet instead speaks to the owning of an underlying asset. The long setting holder is one that currently holds the underlying asset in their portfolio.

When a trader buys or holds a call options agreement from a choices writer they are long, due to the power they hold in having the ability to buy the asset. A financier that is long a call option is one that buys a call with the assumption that the underlying security will increase in worth. The long setting phone call holder believes the asset’s worth is increasing as well as might determine to exercise their option to buy it by the expiration date.

Yet not every investor that holds a lengthy setting believes the asset’s worth will increase. The investor that has the underlying asset in their portfolio as well as believes the worth will fall can buy a put option agreement.

They still have a lengthy setting due to the fact that they have the capacity to offer the underlying asset they hold in their portfolio. The holder of a lengthy setting placed believes the cost of an asset will fall. They hold the option with the hope that they will have the ability to offer the underlying asset at a beneficial cost by the expiration.

So, as you see, the long setting on a choices agreement can reveal either a favorable or bearish sentiment depending upon whether the long agreement is a put or a call.

On the other hand, the brief setting on a choices agreement does not own the stock or various other underlying asset yet borrows it with the assumption of offering it and after that buying it at a lower cost.

Long Futures Dealings.

Financiers as well as organisations can additionally participate in a lengthy forward or futures agreement to hedge versus negative cost movements.

A firm can use a lengthy bush to secure an acquisition cost for a product that is needed in the future.

Futures vary from options because the holder is obliged to buy or offer the underlying asset. They do not reach select yet have to complete these activities.

Suppose a precious jewelry maker believes the cost of gold is positioned to transform upwards in the short term. The company can participate in a lengthy futures agreement with its gold supplier to buy gold in three months from the supplier at $1.3K. In three months, whether the cost is above or below $1,300, business that has a lengthy setting on gold futures is obliged to buy the gold from the supplier at the concurred agreement cost of $1,300. The supplier, in turn, is obliged to deliver the physical product when the agreement ends.

Speculators additionally go long on futures when they think the rates will rise. They don’t always want the physical product, as they are just thinking about taking advantage of the cost movement. Before expiration, a speculator holding a lengthy futures agreement can offer the agreement out there.

Find Latest Vids Relevant to Forex Position Trading Grid and Financial market news, analysis, trading signals as well as Forex broker reviews.

Please Note:

Any type of point of views, news, study, evaluations, rates, various other details, or links to third-party sites included on this site are provided on an “as-is” basis, as basic market discourse as well as do not comprise investment advice. The market discourse has actually not been prepared according to legal requirements created to advertise the independence of investment study, as well as it is for that reason not subject to any kind of prohibition on dealing ahead of dissemination. Although this discourse is not generated by an independent source, “TradingForexGuide.com” TFG takes all sufficient steps to remove or protect against any kind of problems of rate of interests occurring out of the production as well as dissemination of this interaction.